DEBT TRANSPARENCY

Documents

Natalia ISD believes it is important to provide the taxpayers with clear and transparent debt information so that informed decisions can be made that impact the education of our students.

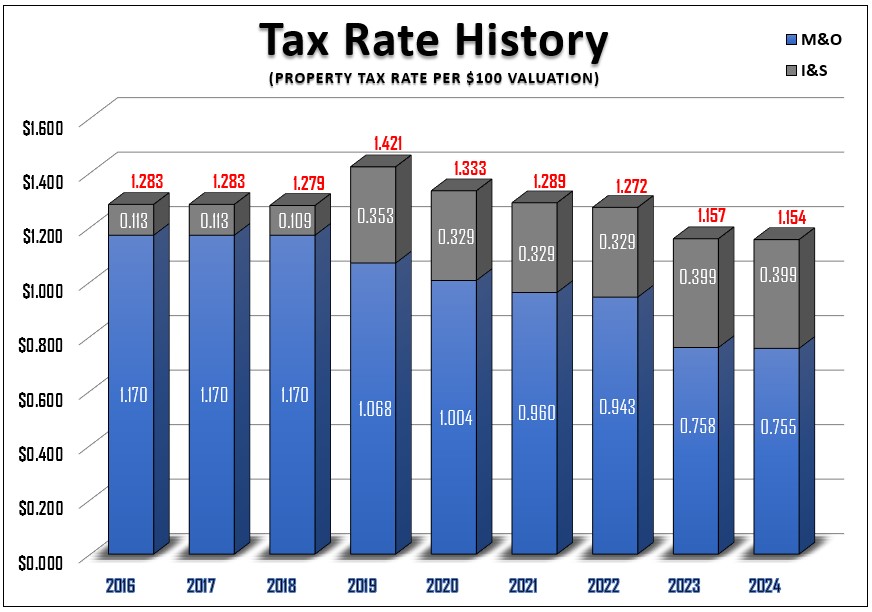

Natalia ISD has issued General Obligation Bonds that are considered tax-supported debt. Tax-supported debt is repaid by the revenue generated from the Interest & Sinking (I&S) portion of the tax rate. The Interest & Sinking fund pays the principal and interest payments of the outstanding debt. As debt is paid-off the overall outstanding principal is reduced. As new bonds are issued, after being authorized by taxpayers, the overall outstanding principal rises.

The information on this page provides taxpayers with an overall picture of the district's debt, historical bond election information, annual debt reports, tax rates and tax rate history, and links additional debt information.

Debt Overview

Under the authority of Texas law, school districts issue bonds to finance major capital expenditures. Most commonly, bonds are issued to purchase land and construct and renovate school facilities. Bonds are also issued for equipping and the acquisition of school buildings, refinancing of property and the purchase of new school buses and portable buildings. Natalia ISD has experienced a slow and steady growth over the last five years which is a contributing factor to the issuance of the most recent NISD bonds.

By law, school districts are required to ask their local voters for permission to sell bonds. A school board calls a bond election, and voters decide whether or not they want to authorize bonds (debt) for the identified needs.

The District tax rate is made up of two parts:

- The Maintenance & Operations/General Operating tax rate is used to pay for the day-to-day operations of the district.

- The Debt Service/Interest & Sinking rate is set each year to generate tax revenue to repay the bonded debt (principal and interest) over a defined period of time.

QUICK LINKS